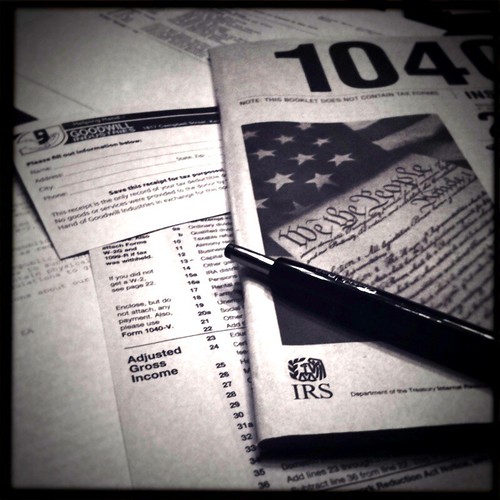

Tax Preparation

During the first quarter of the year, small business owners have much to contend with. As the stress level increases, many Florida small business owners are looking high and low for receipts they have accumulated throughout the year, while hoping all the while to not get audited.

So with March 15 and April 15 on the horizon, here are some tax preparation tips to help make tax season easier.

– IRS Forms make the tax world go ’round. Each type of deduction, income, loss, expense, etc., needs a different form. The same goes for employees. Each classification requires a different form. Knowing what form you need will greatly improve your tax experience.

– Got a home office? Deduct the associated expenses. Home office deductions yield small business owner’s tons of savings each year. Anyone who forgets, or simply neglects this deduction, are missing out.

– Properly classified office equipment expenditures means business savings you can use. The biggest aspect in regards to capital expenditures is to not deduct them as supplies. Supplies, which are pens, paper, and printer ink, are in a different category.

– Insurance premiums that are directly connected to liability, malpractice, and worker’s compensation can usually be deducted as business expenses. The same is true for commercial vehicle insurance and life insurance premiums.

– Time is of the essence, but if crunch time came up too fast, you can file for an extension. However, simply filing for an extension won’t save you the cost of interest and penalties if you owe money. To curb this, calculate what you owe, and include that payment with your extension.

Overwhelmed by tax season? Don’t hesitate to contact us for more information on how we can take the stress out of your taxes.