As a small business owner, you’re required to charge your customers a sales tax on certain types of sales transactions.

Factors like identifying transactions that are taxable, how much you should charge your customers are requirements that vary from state to state. The sales tax you collect is then paid to the state government, which in turn pays it to various local governments. Also, sales tax needs to be recorded in accounting journal, and this is where most small business owners struggle, especially those small business owners who don’t come from an accounting background, for them, making journal entry for sales involving sales tax could be confusing.

In this post we aim to make things simpler and easier for you by explaining how to record a sales transaction involving sales tax is done by bookkeeping services in a accounting journal.

The Two Common Scenarios

In business, you either sell goods on cash or credit. Journal entries for both cases are different. Here, we’ll take a look at both of these cases.

Journal entry for sales on cash

Let’s start with the simpler one first: recording sales tax for cash sales.

Suppose you run a high-end restaurant. Your state requires you to charge 5% tax to your customers on the total bill.

A customer comes to your restaurant, has lunch and asks your waiting staff to present the bill. The bill amount is $500. If you include the tax (5/100 * 500), the final bill amount will be $525. Your customer pays in cash or through credit/debit card and exits the checkout.

How do you make a journal entry for this transaction?

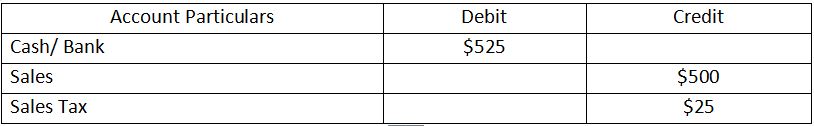

- First, you’ll debit your “Cash/Bank” account with the total amount received, i.e. $525.

- Next, you’ll credit your “Sales” account with the amount billed for your food and service. This is $500.

- Finally, you’ll credit your “Sales Tax”account with the tax amount, which is $25. Sales tax is a liability that your business owes to the government and that’s why the sales tax account gets credited.

This is how your journal should look like:

Once you pay the sales tax to the state government, the Sales Tax account will be debited and the Cash/Bank account will be credited.

This is how you make a journal entry for cash sales involving sales tax.

Journal entry for sales on credit

Next, we take a look at how to make a journal entry for a sale on credit involving sales tax.

We’ll stick to the same example of the high-end restaurant to keep things easy for you to understand.

You run a high-end restaurant. Besides catering to customers who come to your restaurant, you also supply food to corporate clients and event planners. These clients purchase food from you on credit.

You’ve just received an order from one of your clients who runs his own online payroll services company, for food supplies worth $15,000. Since, you’re required to charge 5% tax for the sales, the total billed amount will be $15,750.

To record the transaction in your accounting journal:

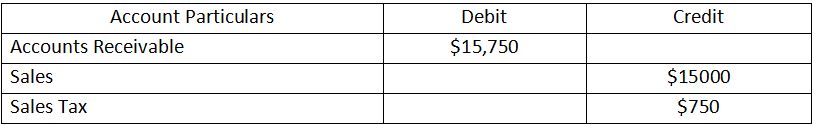

- Debit the “Accounts Receivable”account with the total bill amount, which is $15,750.

- Credit your “Sales” account with the amount billed for your food and service. This is $15,000.

- Credit your “Sales Tax” account with the amount owed in sales tax to the government. This amount is $750.

This is how your journal should look like:

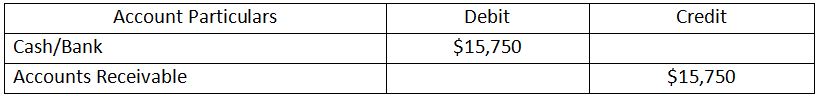

Once you receive the payment from your client for the outstanding bill, proceed by making following entries:

- Debit the “Cash/Bank” account with the amount of payment.

- Credit the “Accounts Receivable” account with the total bill amount.

Your journal should now look like this:

After you pay the sales tax to the state government, credit your Cash/Bank account with $750 and debit your Sales Tax account with $750.

It’s that simple.

Do you have any other questions about accounting sales tax services in general that you would like to ask? Feel free to reach out; our team will be happy to serve you.

A BONUS read: Accounting Basics: Creating an Entry In Your Accounting Journal