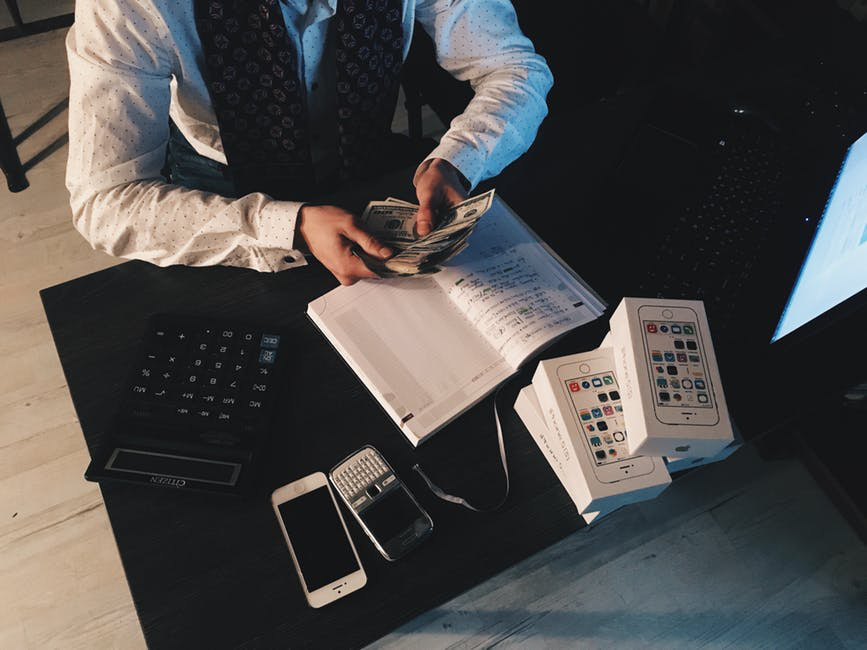

For small business and entrepreneurs, being a victim of fraud is not uncommon. Whether it’s internal fraud, embezzlement, or incorrect financial reporting, fraud is an ever-present financial risk.

In today’s day and age, it’s a risk that comes with conducting business. Before such an event can occur, take the right steps to avoid any form of financial disaster.

Here are some tips which can help your company avoid fraud.

Vigilance

With strong anti-fraud controls at work, it will be difficult for individuals to commit theft. Creating an environment where employees feel comfortable in reporting suspicious behavior will play to your advantage. Fraudsters have known to be caught because of a complaint, tip, or a whistleblowing hotline.

It happens in groups

A common perception of fraud is that it’s done by a single person. In reality however, fraud is more likely to be committed by a group rather than a single person. This form of fraud is more harmful to the finances of a company. This group may comprise of people both inside and out of the company.

Internal fraud

Companies would prefer to view employees as partners rather than potential threats. A report published by KPMG in 2016 reveals that 65 percent of fraud is committed by existing employees, while 21 percent by former employees.

It also reveals that 32 percent of all fraudsters were managers whereas 34 percent were employed at the executive position.

Strengthen your Anti-fraud controls

It’s irrational to assume that victim-organizations of fraud did not have some form of protective measures in place. Most companies perform internal audits and have anti-fraud programs in place for detecting suspicious activities. However, it is crucial for every business to remain up-to-date with the latest fraud techniques and methodologies.

Often the ones committing the fraud are employees at senior management level. Their position allows them to evade anti-fraud protocols and commit crime with relative ease.

Technology

Since the accounting process has become highly automated, it only makes sense to utilize data analytics and process automation software to prevent cyber-fraud. Standardizing system controls and enabling company policies to be enforced automatically can also aid in preventing fraudulent activities.

The importance of having internal control is paramount. Avail our professional accounting services now and have experts perform employee background checks to make sure you have the right people working for your business.

The importance of having internal control is paramount. Avail our professional accounting services now and have experts perform employee background checks to make sure you have the right people working for your business.