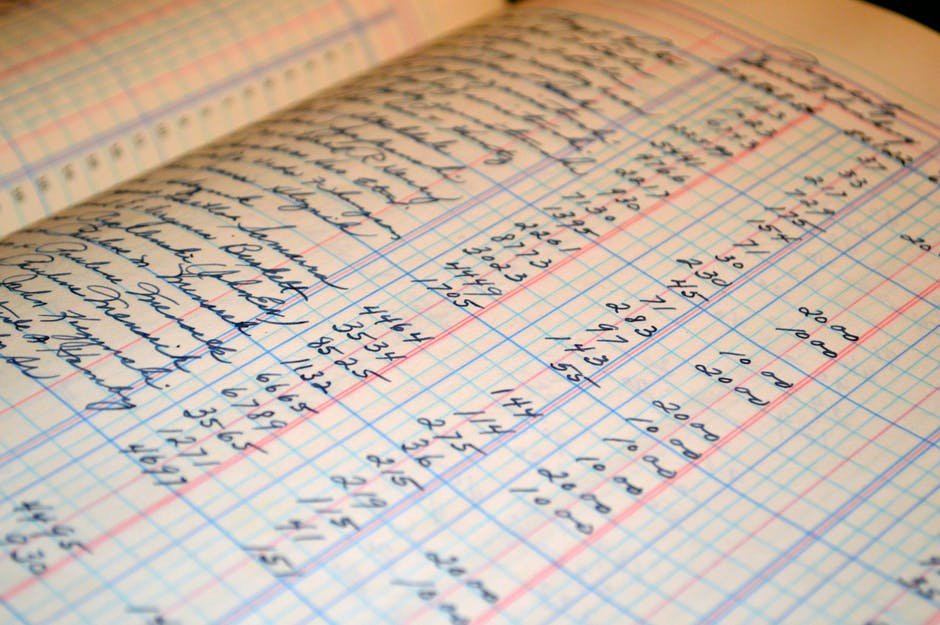

We are talking about everything deemed illegal, unethical or even dishonest. It doesn’t take much for a law abiding citizen to become a convicted criminal. It is usually the pressure of sustaining accounting for small business that pushes business owners to take action and land in trouble. And since, certain accounting tricks are so subtle in nature; small business owners hardly realize they are committing a fraud.

Have you ever wondered how far you are willing to go to make more money and save your business?

While doing everything they can to stretch their potential and resources is always important to run a business, there are some lines that business owners should never be willing to cross.

Here are some accounting tricks that may not seem like a major fraud, but could land a person in jail if they are detected by the authorities.

Recording Revenue Prematurely

Under the revenue recognition principle, revenues are to be recorded as they are earned.

It is common for small businesses in the service sector to violate this principle and record the entire multi-year contract in one year to boost the sales. Another way businesses do this is by offering multi-year contracts at high discounts to customers and recording them at full value in the books.

Recording Fake Sales

Another accounting for small business trick that some business owners are involved in is recording fake sales at the end of the year to boost revenue.

This happens by asking family and friends to place orders on the last day of the year. Since orders are recorded and the items are shipped. Fake orders can be recorded as sales. However, the ‘customers’ don’t intend on keeping items. And return them as soon as they receive them. But the books for the year can’t be changed as the return will only be made the following year.

Not Recording Expenses

An asset bought for $100,000 with a useful life of 5 years should have $20,000 of depreciation. Deducted from the operating expenses each year. According to the straight line method.

However, falsely misclassifying assets to have a useful life of 10 years. And reducing the depreciation to $10,000 for boosting the profit is fraud.

Claiming Wrong Deductions

For small business owners, it is common to mingle personal expenses with business expenses. Deducting home grocery bills from business. Income can come across as a mistake. Writing off a family vacation as a business expenses is just plain fraud. This could lead to imprisonment of up to 3 years and fines in hundreds of thousands of dollars.

The IRS provides comprehensive guide to small business owners for deductible business expenses, which all small business owners must always consider following.

About Accounting For Small Business

A&B Solutions provide accounting, professional bookkeeping services and tax services to small and medium sized businesses in Boca Raton and in other cities of Florida.

A&B Solutions have helped many clients over the past few years and are known for our commitment to professionalism and friendly business support. For more details call 954-596-9966.