Do you often find yourself confused when recording a business transaction in your accounting journal, struggling to figure out which account should be debited and which one credited? If so, then you have come to the right place. Today, we will be teaching you how to create an entry in an accounting journal like any accounting and taxation services company makes, following a business transaction. But before we proceed with that, let’s revisit the definition of an accounting journal, so that those of you who don’t know what it is, would be able to understand what we are talking about and follow our instructions easily.

What is an accounting journal?

Simply put, an accounting journal is like a register where you record all your business transactions for your reference. Just by looking at it, you can tell when a particular transaction was made, how much money was involved in the transaction, why was it made and what impact it had on your business accounts.

There are seven different types of accounting journal that top accounting consulting firms uses, however, the general journal is often the most used one. You can record all types of transactions in a general journal. Other journals are specialized and can only be used for recording specific types of transactions. Since general journals fit all purposes, we would like to keep our discussion limited to them. Don’t worry though, because the rules of creating an entry in an accounting journal are same for all types of journals.

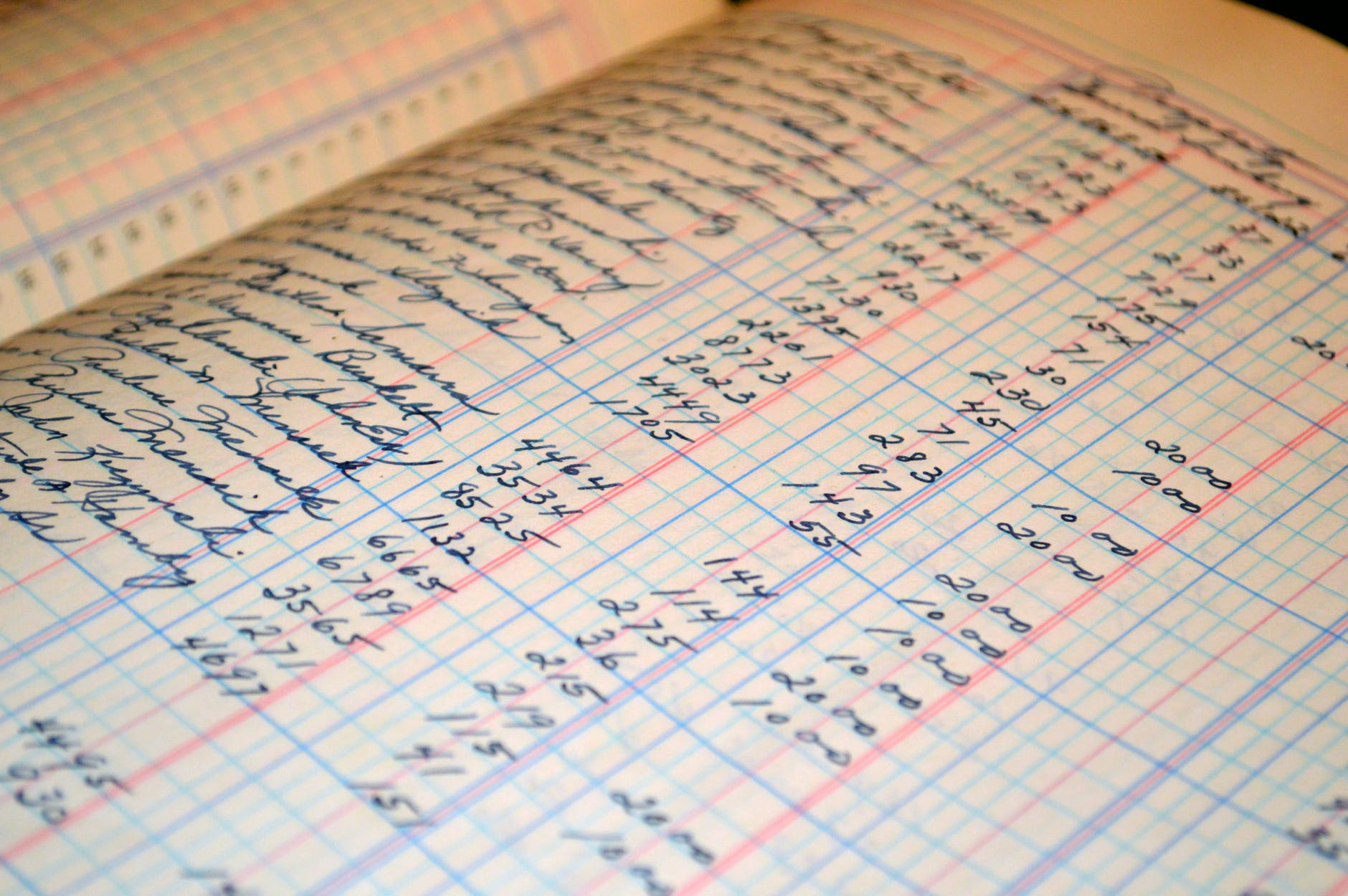

Here is what a typical general journal looks like:

All entries in the accounting journal are listed in chronological order. In the “Date” column you enter the date of transaction.

In the “Accounts/Explanation” you enter the details of the accounts impacted by the transaction. Remember, every business transaction impacts two accounts. One account gets debited, while the other account gets credited. The account that gets debited should be listed first when recording a transaction. The account that gets credited is mentioned on the next line with an indentation. The “Debit” column contains the amount an account gets debited for, and in the “Credit” column you enter the amount the other account gets credited for.

Now comes the main part:

How to create an entry in an accounting journal?

To understand which account gets debited and which account gets credited, you first need to understand the accounting equation. The accounting equation states that:

Assets = Liabilities + Owner’s Equity

Every transaction you make will always impact either one of your assets, liabilities, owner’s equity or a combination of any two of the three variables part of the accounting equation. For instance, let’s say you purchase inventory for your business on cash. The two accounts that get impacted by this transaction are your inventory/stock account and cash account. Both these accounts are classified as assets.

Let’s look at another example. Suppose you pay one of your creditors by cash for the amount you owe to them. The two accounts that get impacted by this transaction are your cash account and creditor’s account. Cash is an asset, while creditor is a liability for your business. Whenever a transaction positively impacts your assets, that transaction gets debited under the particular asset’s account. If it negatively impacts your assets, it gets credited. In case of a liability, if a transaction increases your liability, that transaction gets credited. If it decreases your liability, it gets credited. The same rule applies to owner’s equity. That’s why they both are on the same side of the accounting equation.

In summary:

Assets “ – Debit

Assets ”- Credit

Liabilities “ – Credit

Liabilities ” – Debit

Capital“ – Credit

Capital” – Debit

Recording a transaction:

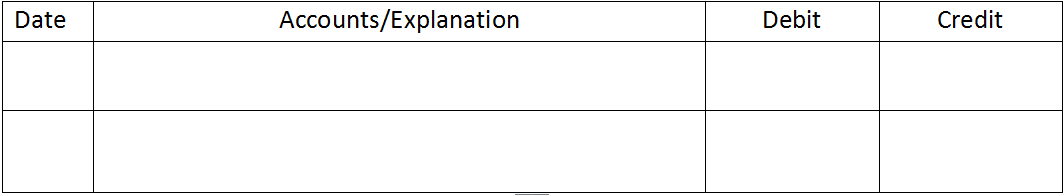

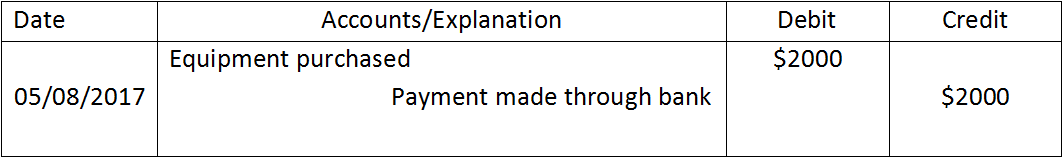

Here is an example of a business transaction and how it should be recorded in a general journal. Mr. Y purchase an equipment for his auto repair shop for $2000. The payment is made through check and the transaction was performed on 5th of August, 2017. The two accounts that get impacted are the equipment account and the bank account. Both these accounts are your assets. The impact of the transaction on the two accounts is as follows:

- Equipment

- Bank

Looking at the summary chart, your Equipment account should get debited and your bank account should get credited.

And this is how you create an entry in accounting journal. Did you find the post helpful? Let us know in the comments section below, we would love to hear from you. If you need any help with your accounting processes, we can also assist you in that. Our team provides accounting and professional bookkeeping services to all types of small and medium sized businesses in South Florida. Contact us for a free initial consultation.

A BONUS read: Conquering the 3 Most Common Payroll Challenges